Bring up the subject of locums and sometime in the next few sentences you’re more or less guaranteed to hear the phrase “HOW much?”, either from the indignation of those that hire locums or employees jealous of the locum’s day rate. The standard reaction for many people seems to be to take a locum’s day rate, multiply by 5 (days) then 52 (weeks) and come up with something astronomical as an annual salary. A few years of that, you might be thinking, and I can buy a small island, retire and only need to encounter animals in the form of furry companions. Sadly, the numbers leave just one or two details out. Since nowhere seems to go into these details, it’s probably worth trying to make things a little clearer to tackle this perception gap.

We are also very bad in the veterinary profession, and in the UK in particular, in talking about money. It is like the first rule of salary club is that you don’t talk about salary club – although most contracts do have more or less this exact rule written in even though this is illegal. I will use this article to simply try and get the ideas across rather than a list of calculations which only make sense if you already know why they make sense.

So why, then, is the blindingly obvious calculation wrong*? (*Calculations at the end of the article.)

Recent changes

Recently, the supply and demand of free market forces due to the retainment and recruitment crisis in the profession (you can read about this in other articles I’ve written) has led to rapid inflation of staffing costs. Yet practices can only have income if there are vets there to do the billable work. Permanent employees need holidays, days off for CPD, illness and injury, and there are increasing rota gaps where recruitment has failed to find replacement permanent staff. In the past couple of years, employee salaries and locum rates have increased greatly. As locums are on short, temporary contracts the average upward trend in rates happens much faster than for employees who generally get a smaller annual salary increase and can frequently only negotiate significantly higher salaries when they move practices. Therefore, the rate increase for locums has been faster than that for permanent staff in the past couple of years.

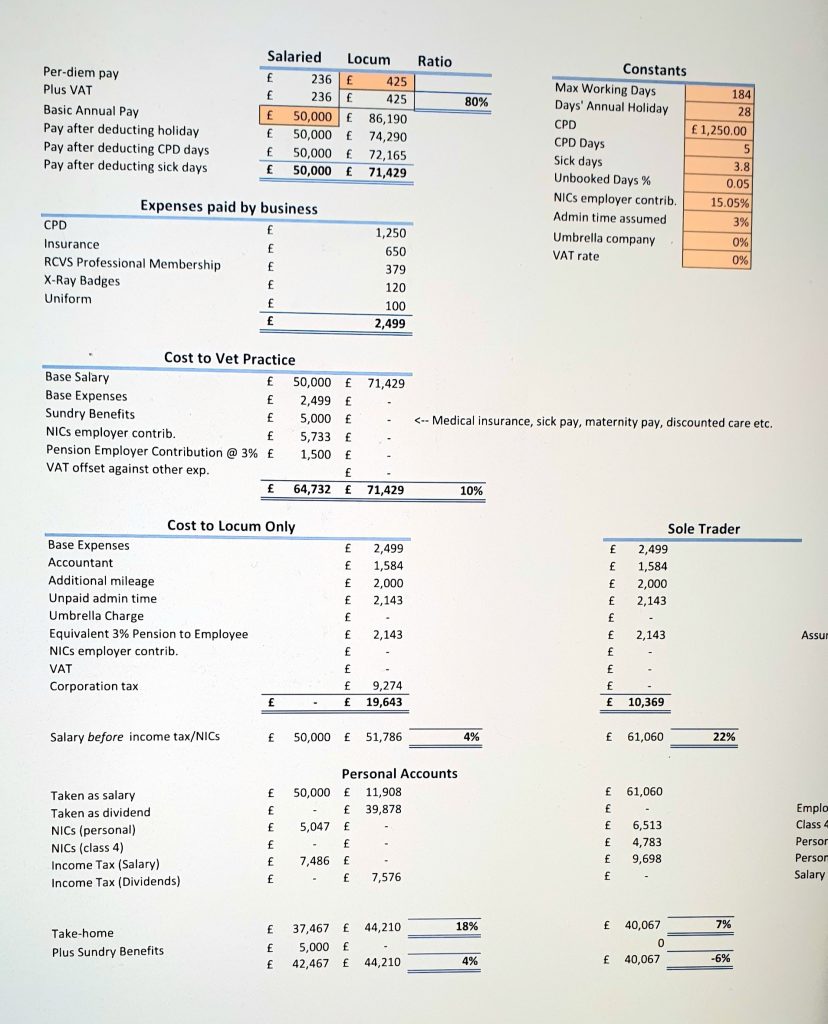

There used to be fairly generous tax advantages of being self-employed especially through personal service companies (limited company locums) but these have been reduced and the margin over a PAYE permanent employee has narrowed. Once the additional expenses have been considered, this difference is mainly wiped out. Taxes applicable to employees are often overlooked when looking at locum vs employee rates of pay – did you know that employers pay NI at a rate of 15.05% of your salary direct to the government? Businesses don’t pay employer’s NI on locum rates (for limited company locums and sole-trader locums, but they do for locums on zero-hour contracts).

Since April 2021, significant changes in the off-payroll working rules (called IR35) were brought in which aimed to ensure that individuals who work like employees but operate through their own limited company (known as Personal Service Company or PSC) pay broadly the same tax and NIC as employees. The responsibility for carrying out the assessments and the risks of wrongful application shifted from the locum to the medium or large company engaging them (that is, most corporate practices). Small businesses were exempt from this change and the locum remains liable as before the April 2021 change. To negate the risk these types of practices began to insist locums be engaged either via zero-hour/casual worker/bank contracts or umbrella companies (see below), even if the locums were not operating through a PSC. This stance has been relaxed by some corporates in some circumstances allowing locums to be paid as sole traders but then retracted in recent months by cancelling already contracted and booked work with a locum and requiring them to sign a zero-hours/casual workers contract if they want the booked work.

Who’s quoting the rate?

The first point to consider when a locum day rate is being considered is what does that rate include? I have found some people quoting the day rate of locums inclusive of 20% VAT. But VAT is irrelevant for a veterinary practice as it is a VAT registered business and hiring a locum is an allowable expense, so the VAT cost of the locum is just written off against their quarterly VAT bill. This is nil sum and so it should not be included in a locum rate quote.

The next crucial aspect is if the locum is being hired via an agency. An agency works like a dating service, matching locums and practices with each other. Some agencies also act as an umbrella company which is used to pay the locum, but we will discuss this separately. For this matching service, the agency charges the practice; currently this is £40-50 per day but can be up to £60 a day. This is money that the practice pays but the locum does not see – it goes straight to the agency for the services they provide (or not – we can discuss this in another article). Neither practices nor locums need to use agencies but some choose to due to convenience, or filling urgent calendar gaps that might otherwise mean the practice has to close or the staff member not go on holiday. Some locums even find they get booked via an agency to the same practices they have previously contacted directly and got no response from!

I mentioned umbrella companies. These companies employ short-term contractors (the locums) and act as an intermediatory between the practice and the locum. Some veterinary practices, in particular the corporate groups, will only employ locums via umbrella companies as the risks of these locums being seen as employees is taken on by the umbrella company which acts as the locum’s employer. Some locums also choose to be contracted via umbrella companies as it can be convenient. However, umbrella companies have a cost, a huge cost. Because the umbrella company is employing the locum on the practices behalf, all the costs that an employer would normally have to pay to have employees (over and above the salary, such as employers NI, holiday pay, sick pay,…… and an apprenticeship levy) get passed to the locum together with administrative fees from the umbrella company for the pleasure of using them. In effect the locum is subject to double taxation and additional deductions, with the end result being a loss of 40-50% of the gross daily rate involved. Plus using an umbrella company is not tax efficient and very few expenses can be taken into account. This means that the costs to a locum of using an umbrella company are far higher than a locum paid by any other means by about 30%. Now most of us would not be happy taking a 30% pay cut for a middle-man and neither is the locum and so the locum passes some of these extra costs to whoever hires them i.e. the practice. Most of the time the practice does not have to employ the locum via an umbrella company but because corporate companies don’t like risk (IR35 related), they continue to require locums to be paid via umbrellas and so the locum passes some of the extra cost to the practices. The increase in locum daily rates and the rate of these increases in recent years could in part be due to an increasing proportion of locums using umbrella companies and the need to offset the extra loses involved.

The Locums Point of View

The biggest factor for those choosing to locum is the ability to work flexibly not for a supposed higher salary (see my previous article on ‘why so many are turning to locuming’ and Recruit4vets survey). This is down to deficiencies in the employee jobs being offered not always a direct drive to want to locum. I can, however, see two groups of veterinary employees that can earn significantly more as locums than as employees; these are early career vets and nurses at all levels of experience. The latter is not surprising as most of us are aware of how poorly paid nurses are; an employee nurse would expect a mean of £13/hour for a £26k salary, whereas a locum nurse can expect £20-25/hour with a mean of £23.50 (numbers from 22/23 SPVS salary survey). So, for nurses, it is not surprising they are turning to locum work to give themselves a realistic living wage (read more about salaries in the veterinary profession in this article).

A locum has things they need to pay for that an employee doesn’t; their VDS cover, RCVS fees, x-ray badges and uniform costs, an accountant. As we all need to do CPD, a locum needs to pay for their own CPD but they also cannot earn on the times they are doing CPD (whereas the normal is for employees to have 5 days salary paid to allow them to do CPD). A locum also doesn’t earn while on holiday, whereas an employee gets paid time off. There’s admin time – invoicing, chasing up debtors, looking for contracts. Locums often have to drive or travel further to the work which means more fuel for the car and wear and tear, plus the extra time taken in travelling.

A locum takes on a great many risks in their line of work, risks that an employee just doesn’t have. They have no job security at all, have no employment rights and can be dismissed with no or little notice, as evidenced by what happened at the start of the COVID pandemic. Locums get none of the additional benefits or securities that employees enjoy like sick pay, enhanced maternity pay, or employer pension contributions. Locums are also going to struggle to get any career progression. Some locums have self-funded certificates in order to give career progression, but this is not usual.

The higher potential rate of income that locums can achieve relies on locums being able to fill their entire calendar minus holidays they allow themselves. This just doesn’t happen – there are quiet times of the year, short-notice cancellations etc. Some of this time could be taken as holiday but if not planned by the locum it affects their income. How would an employee take it if they turned up to work to find it so quiet their boss sent them home and with no pay? I’m sure the boss would be happy but the employee not so much and yet this is what locums are asked to do daily. It is up to the locum to find new roles and fill their gaps in their schedule and this also takes a lot of time and effort to do.

Employees Point of View

Employees get a total compensation package of salary and benefits that locums don’t. You’ll usually spot these listed in job ads as fantastic benefits of working for a given practice: annual leave, pension contributions, CPD of £x and 5 days off, and so forth. What about your professional indemnity insurance (VDS cover) and RCVS membership? Perhaps you also get an association membership or two? As an employee, perhaps you haven’t worked out how much these are worth? (have a look at this video from VSGD which explains these).

Annual leave isn’t time that the practice is kind-hearted enough to give you off, it’s legally required time during which you still receive a full salary. In other words, you work for (say) 46 weeks a year, you get paid for the full 52, and the practice is picking up the tab for getting somebody else to cover those extra weeks you have as holiday. A locum, on the other hand, doesn’t get paid if they don’t show up. Ditto for sick days which, according to the Office for National Statistics, was about 3.8 days on average in 2020 after filtering out COVID effects.

Similarly for the pension, an employee is entitled to it whether the practice likes it or not (it is a legal requirement now) and that’s an additional cost to them that’s not included in your salary which is likely to be worth somewhere between one and two thousand pounds a year. An employee (almost certainly) gets a CPD allowance of probably a few thousand pounds that a locum would have to pay for themselves, again a cost to the business above your salary.

In this recruitment crisis, more and more employers are offering enhanced benefits such as sick pay beyond the legal requirement, enhanced maternity pay, private medical insurance (worth £1-3k a year), and discounted staff pet care. Guess what? Locums don’t get any of these.

Employer/Hirer point of view

Hiring a limited company locum, a sole-trader locum, or an umbrella locum has no extra costs to a practice whereas a zero-hours/casual worker locum attracts employer NI, holiday pay and potentially pension contribution costs. An employer has those and a great many and mounting additional costs to consider as part of the salary benefits package (see above) and the costs of having employees. Locums do not give ongoing HR headaches or have employee rights and are able to be dismissed with little or no notice if business needs change. Another cost that doesn’t need to be paid if you have locums are the recruiting and training costs. Hiring a regular employee requires the practice to invest time and resources into recruiting, interviewing, and training new employees. This can take weeks or months during which there is lost productivity by the new employee and those doing the training. With a locum, there is typically little to no training required as they are experienced professionals who can quickly adapt to the practice’s protocols.

There are certain expenses which are either fixed or very similar, and which are paid by the business. That’s CPD, pension, insurance, memberships and employer national insurance contributions. These together come to nearly £15,000 a year on a £50k annual salary (see the calculations). The difference is that for an employee, your employer pays all this for you out of their pocket. For a locum, this comes out of their end.

Looking at the figures and figuring out how much the intangible costs are for a business, perhaps it might actually be cheaper to have your practice staffed entirely by locums? I am being facetious here, but it makes you think…

Summary

Using a very simplistic spreadsheet based on a whole load of assumptions, I’ve worked out that a locum needs to charge a day rate about 80% higher than an equivalent salaried rate just to have the same amount in their pocket at the end of the month as an employee. Probably more surprising is that the cost to the practice is similar to the ‘cheaper’ employee.

The take-away is that a salaried employee costs a vet practice way more than their salary, while a locum not only has those charges to pay themselves, but also a load more costs and taxes to pay on top of that. They also have the uncertainty of knowing if they’re going to be able to book work or will actually get to do the work that was booked, plus the hassle and costs of running a company. The trade-off for a locum’s flexibility is the lack of stability and a massive increase in risks.

That day rate that made you wince isn’t what it seems! Achieving a fair and reasonable rate for all is a process of negotiation, with underlying understanding of why the bottom-line price is not all that need to be considered.

*In the interests of keeping this simple, I am going to leave out discussions on VAT and have simplified tax/NI to some degree because firstly, I’m not an accountant and these things tax my brain, and secondly unless you are an accountant, you will probably want to curl up in a ball weeping softly to yourself if we got granular on tax and NIC! You also need to bear in mind that I have used average rates for salaries and locum rates whereas those with more experience or skill can command higher rates, and filling shifts in unsocial hours like overnight will also attract a premium. The rates and taxes are correct for 22/23.

References

SPVS 22/23 Salary survey – summary available to those that took part, full survey to members, a brief summary here.

Recruit4Vets Locum Salary Survey 2022

Terms

NI – National Insurance

NIC – National Insurance Contributions

VAT – Value Added Tax

CPD – Continuing Professional Development

PAYE – pay as you earn – this is the Governments way of collecting income tax and NIC from employment. This is why the money you are paid each month does not equal a twelfth of the salary.

VDS – Veterinary Defence Society – professional indemnity insurance provider in the UK

RCVS – Royal College of Veterinary Surgeons – licensing board for vets in the UK

9 May 2023 at 2:50 pm

Hello, I love this article. Full of clear, concise information from all aspects.

One thing though, not all agencies charge the practice as much as £40 upwards. I find my work through a small independent agency in the Brisol area who charges just £34.

I hope you do manage to get this article published and widely circulated. Well done!

10 May 2023 at 9:41 pm

Hi Deena,

Thank you for your comment. To research the article, I asked a group of veterinary business owners how much they pay an agency to source a locum vet and the quoted rate is what they unanimously reported.